Building a Scalping Strategy using Adaptrade – A Comprehensive Guide

Are you interested in learning how to build a +scalping strategy using adaptrade? Look no further! In this detailed guide, we will walk you through the step-by-step process of creating an effective scalping strategy using the power of Adaptrade. Scalping strategies are designed to take advantage of short-term price fluctuations, and by incorporating Adaptrade into your approach, you can enhance your trading results. Whether you’re a beginner or an experienced trader, this article will provide you with valuable insights and techniques to improve your scalping strategy. Get ready to optimize your trading performance with Veneziabeachv.vn.

| Key Takeaways |

|---|

| Understand the basics of scalping strategy |

| Learn about Adaptrade and its advantages for scalping |

| Discover the step-by-step process of building a scalping strategy |

| Consider important factors while developing your strategy |

| Master testing and optimization techniques for optimal results |

| Implement your scalping strategy effectively in the market |

| Monitor and make necessary adjustments for ongoing success |

I. What is scalping and why is it popular?

Scalping is a trading strategy that involves taking advantage of small price movements in the market to generate quick profits. Traders who use scalping strategies aim to enter and exit trades within a short period, often within minutes or even seconds. This approach can be highly profitable if executed correctly.

Scalping has gained popularity among traders for several reasons. Firstly, scalping allows traders to capitalize on short-term market fluctuations, making it suitable for those who prefer an active and fast-paced trading style. Secondly, scalping strategies often involve high-frequency trades, which can lead to multiple opportunities for profit throughout the day. This frequent trading can potentially increase the overall profitability of a trading strategy.

II. Understanding the Basics of Adaptrade

What is Adaptrade?

Adaptrade is a powerful platform designed to assist traders in developing and optimizing their trading strategies. It provides a comprehensive suite of tools and features that streamline the process of strategy development, testing, and implementation. By leveraging Adaptrade, traders can enhance their trading performance and achieve more consistent profits.

Benefits of Using Adaptrade

There are several advantages to using Adaptrade in your trading activities:

- Efficiency: Adaptrade significantly reduces the time and effort required to develop and test trading strategies, allowing traders to focus on other important aspects of their trading business.

- Automation: The platform offers automation capabilities, enabling traders to execute trades based on predefined conditions and criteria. This automation can save time and improve execution accuracy.

- Data Analysis: Adaptrade provides powerful data analysis tools that allow traders to identify patterns, trends, and correlations in historical market data. This analysis can provide valuable insights for strategy development.

- Optimization: Adaptrade’s optimization tools help traders fine-tune their strategies by identifying the most profitable settings for various parameters. This optimization process can maximize profits and minimize risks.

Key Features of Adaptrade

Adaptrade offers a range of features that assist traders in building and improving their trading strategies:

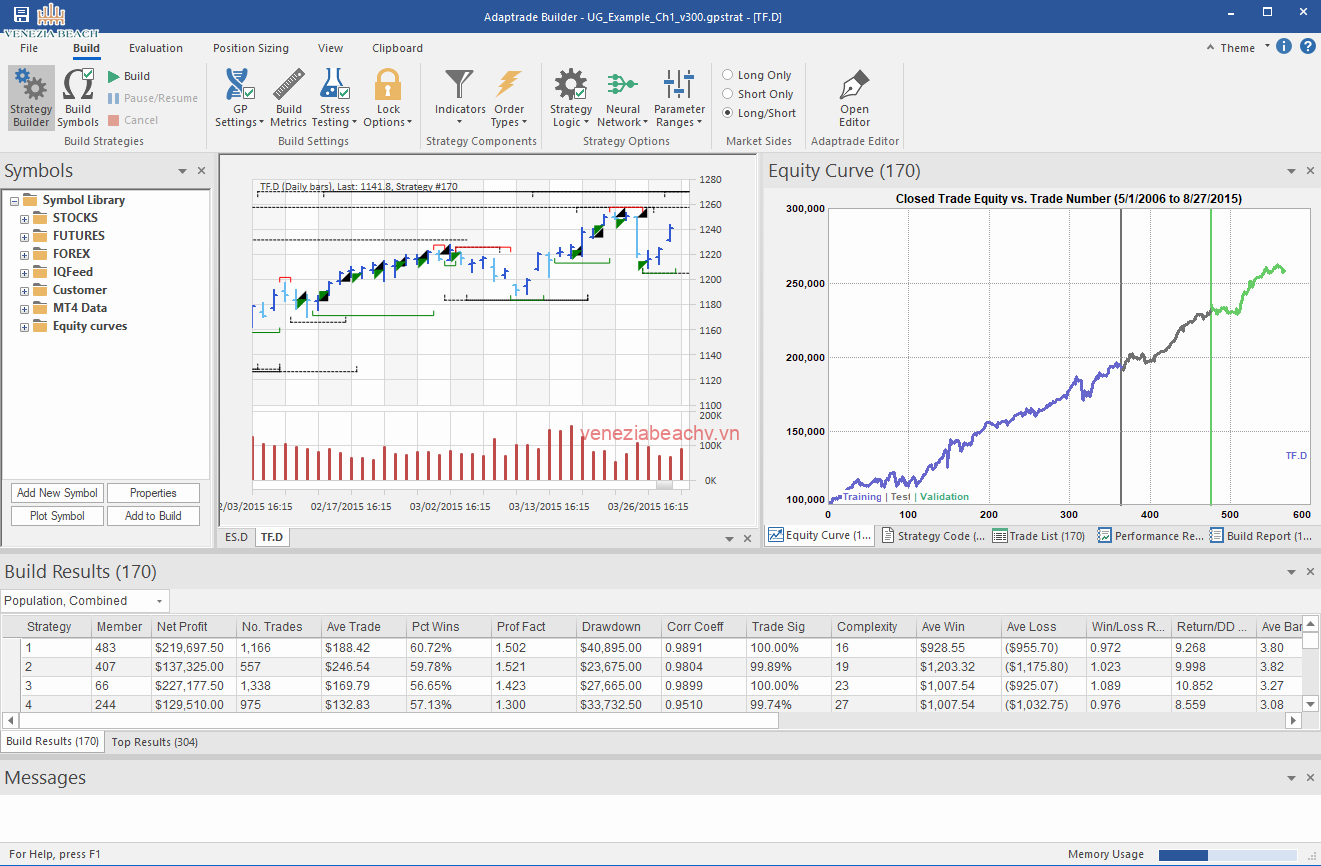

- Strategy Builder: The platform includes a strategy builder that allows traders to define their entry and exit rules, money management techniques, and risk management parameters.

- Backtesting: Traders can test their strategies using historical market data to evaluate their performance and make necessary adjustments.

- Optimization Tools: Adaptrade offers powerful optimization tools that help traders identify the best parameter values for their strategies, maximizing profitability.

- Robustness Testing: Traders can assess the robustness of their strategies by subjecting them to different market conditions and scenarios.

- Portfolio Testing: Adaptrade allows traders to test their strategies across multiple assets or instruments to diversify their trading approach.

Getting Started with Adaptrade

To begin using Adaptrade, traders need to familiarize themselves with the platform’s features and functionality. It is recommended to start with the strategy builder, where traders can define their trading rules and parameters. After building a strategy, it is essential to test and optimize it using historical market data. Once the strategy has been refined, traders can implement it in live trading and monitor its performance closely.

III. Step-by-step guide on building a scalping strategy using Adaptrade

1. Define your goals and trading style

Before diving into building your scalping strategy, it’s essential to define your goals and trading style. Consider what you want to achieve with your scalping strategy and the level of risk you are comfortable with. Are you looking for quick profits with multiple small trades or larger gains with fewer trades?

Additionally, determine your preferred trading timeframes and the markets you want to focus on. This will help you tailor your strategy to fit your specific trading preferences and increase your chances of success.

| Related Posts: | How to Add Words to E-Sword Dictionary |

| How to Get Free Credits on SmartJailMail |

2. Research and select suitable technical indicators

Technical indicators play a crucial role in developing a scalping strategy. They help you identify potential trade opportunities and make informed decisions. Conduct thorough research to find suitable indicators for scalping, considering factors such as accuracy, ease of use, and compatibility with the Adaptrade platform.

Popular technical indicators for scalping include moving averages, Bollinger Bands, stochastic oscillators, and relative strength index (RSI). Experiment with different indicators and combinations to find the ones that work best for your trading style.

| Related Posts: | How to Have a Sissygasm |

| How to Get My Husband on My Side Manwha |

3. Set up Adaptrade and develop your strategy

Once you have defined your goals and selected suitable indicators, it’s time to set up the Adaptrade platform and start developing your scalping strategy. Familiarize yourself with the features of Adaptrade and its functionalities for optimizing trading strategies.

Begin by creating a new strategy and inputting the selected technical indicators. Customize the parameters and settings based on your research and trading style. It’s crucial to backtest your strategy using historical data to refine and improve its performance.

| Related Posts: | How to Replace Roman Tub Faucet with No Access Panel |

| How to Use a Rose on a Virgin |

IV. Conclusion

In conclusion, building a scalping strategy using Adaptrade can significantly enhance your trading performance. By understanding the basics of scalping strategy, leveraging the features of Adaptrade, considering important factors, testing and optimizing your strategy, and implementing it effectively in the market, you can increase your chances of achieving consistent profits. However, it’s important to continuously monitor your strategy and make necessary adjustments to adapt to changing market conditions. With the knowledge and tools gained from this comprehensive guide, you’ll be well-equipped to take your scalping strategy to the next level and stay ahead in the competitive trading landscape.