The Significance of 1.20x Risk in Mathematics

When it comes to understanding risk in the realm of mathematics, the concept of 1.20x risk holds significant importance. In this article by Veneziabeachv.vn, we will explore what exactly 1.20x risk means in the context of mathematics. We will delve into its calculation process, interpret its meaning, and examine its implications in decision-making. By the end of this article, you will have a comprehensive understanding of 1.20x risk and its applications.

| Key Takeaways |

|---|

| Definition and explanation of 1.20x risk in mathematical terms |

| Step-by-step guide to calculating 1.20x risk |

| Interpreting the meaning of 1.20x risk in various scenarios |

| Understanding the relationship between 1.20x risk and probability |

| Examining the impact of 1.20x risk on decision-making processes |

| Real-life examples and applications of 1.20x risk |

I. Understanding Risk and its Mathematical Definition

Risk: A Fundamental Concept in Mathematics

In the realm of mathematics, risk is a fundamental concept that plays a crucial role in various fields such as finance, statistics, and decision-making. It refers to the potential for an event or outcome to deviate from its expected or desired result. Risk encompasses both uncertainty and probability, allowing us to quantify and analyze the likelihood of different outcomes.

The Significance of 1.20x Risk

When we specifically discuss 1.20x risk, we are referring to a scenario where there is a 20% higher chance of encountering unfavorable outcomes compared to the baseline level of risk.

“1.20x risk” can be interpreted as taking on additional vulnerability or exposure that exceeds the standard level by 20%.

| See related post: What Does It Mean When a Deer Crosses Your Path? |

Mathematical Definition of Risk

In mathematical terms, risk can be expressed using various methods such as probability theory and statistical analysis. Probability allows us to assign values that represent the likelihood of different outcomes occurring within a given context. Additionally:

- Risk coefficients are often used to quantify the potential impact or deviation from desired results across different scenarios.

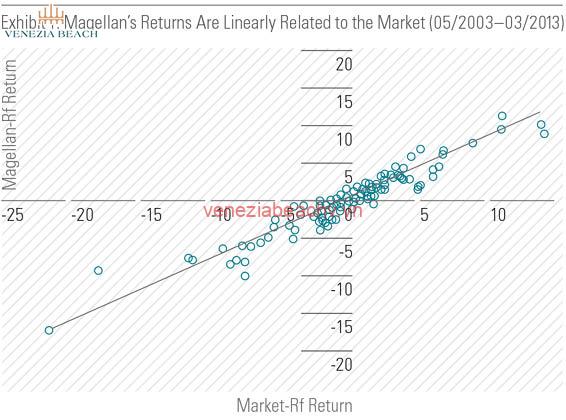

- Returns on investment are assessed based on their associated risks using metrics like volatility and standard deviation.

- Risk mitigation strategies involve reducing exposure to adverse outcomes through diversification or hedging techniques.

| See related post: What Do “Cracking 4s” Mean? |

Risk Analysis and Decision-Making

The concept of risk is integral to decision-making processes. It is essential to evaluate potential risks and rewards carefully before making choices. Risk analysis involves assessing the probability and potential impact of different outcomes, allowing individuals or organizations to make informed decisions based on their risk tolerance.

“Understanding 1.20x risk can empower individuals and organizations to incorporate a higher degree of caution into their decision-making processes, accommodating the potential for greater adverse outcomes.”

- Businesses often conduct risk assessments to identify potential threats that may impact their operations and develop strategies for mitigating those risks.

- Investors analyze different asset classes, considering their associated risks, returns, and correlation with other investments in order to build diversified portfolios.

- In personal decision-making, understanding the concept of risk helps individuals weigh the pros and cons before embarking on major life choices or financial commitments.

| See related post: What Does Service Driver Assist System Mean? |

II. Exploring the Concept of 20x Risk

Understanding the Definition and Significance

The concept of 1.20x risk is a fundamental aspect of risk assessment in mathematics. It refers to a level of risk that is 1.20 times higher than the baseline or original risk. In simple terms, it implies an increased probability of an event or outcome occurring. This concept holds significant importance in various fields, such as finance, investment, and statistical analysis. By quantifying the risk factor as 1.20x, it allows for a more precise evaluation of potential outcomes and aids decision-making processes.

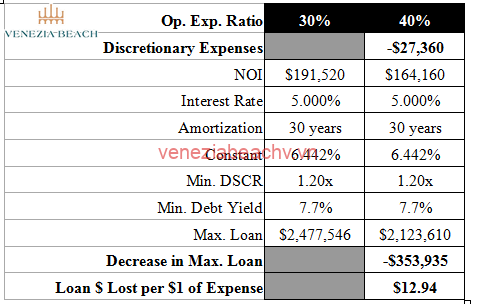

For instance, if the baseline risk of an investment is determined to be 10%, the 1.20x risk would indicate a risk level of 12%. This higher level of risk implies a greater chance of experiencing negative outcomes or losses. Understanding the concept of 1.20x risk is essential for individuals and organizations involved in risk management to assess the potential impact of their decisions and take appropriate actions to mitigate risks.

Calculating 1.20x Risk

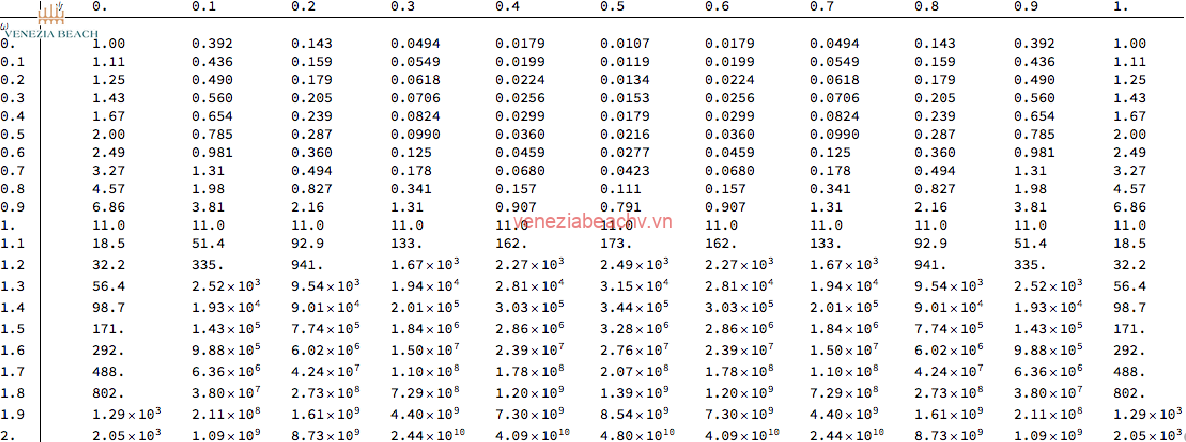

Calculating 1.20x risk involves a straightforward mathematical operation that requires multiplying the original risk by 1.20. The method is as follows:

- Determine the baseline probability or risk of the event or outcome.

- Multiply the baseline risk by 1.20 to calculate the 1.20x risk.

It is important to note that the calculation of 1.20x risk is a simple multiplication process that allows for a clear understanding of the increased risk associated with an event. This approach provides a valuable quantitative measure for decision-makers to assess and compare different risks in a meaningful way.

III. Factors Influencing 20x Risk

Economic Conditions

The economic conditions play a crucial role in determining the level of 20x risk. During periods of economic uncertainty or recession, the likelihood of experiencing higher risk increases. This can be attributed to factors such as market volatility, reduced consumer spending, and decreased business investments. Additionally, factors like inflation rates, interest rates, and geopolitical events can also impact 20x risk. For example, an increase in interest rates may lead to higher borrowing costs for businesses and individuals, resulting in elevated risk levels.

Industry-Specific Factors

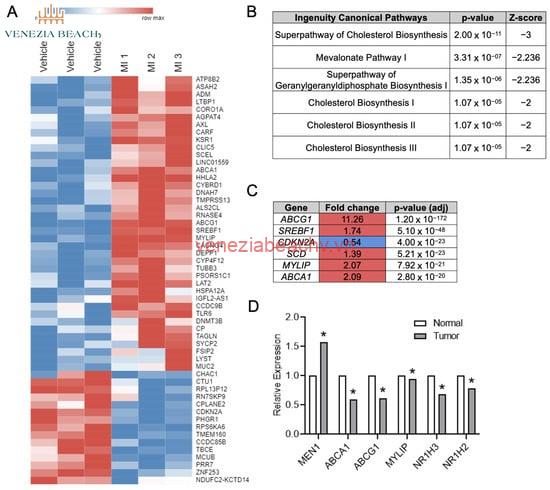

Another key factor influencing 20x risk is industry-specific dynamics. Each industry operates within its unique set of circumstances and challenges, which can significantly impact the level of risk involved. Factors such as barriers to entry, competition, regulatory environment, technological advancements, and market demand heavily influence the risk exposure for businesses operating in particular sectors. It’s important to analyze these industry-specific factors when assessing 20x risk, as they provide valuable insights into the potential risks associated with specific industries or sectors.

Company Financials

The financial health and performance of a company is a critical determinant of 20x risk. Companies with strong financials, including stable cash flows, low debt levels, and healthy profitability, are likely to have lower risk profiles compared to those facing financial difficulties. Assessing key financial metrics such as leverage ratios, liquidity ratios, and profitability indicators can help investors and decision-makers understand the level of risk associated with a specific company. Furthermore, factors like management ise, corporate governance, and strategic planning also contribute to the overall risk profile of a company.

IV. Practical Applications of 20x Risk

The concept of 1.20x risk finds practical application in various fields, offering insights into decision-making processes and potential outcomes. Let’s explore some real-life scenarios where understanding and evaluating 1.20x risk can be valuable.

1. Financial Investments

In the world of finance, investors often rely on risk assessment to make informed decisions. Understanding the concept of 1.20x risk allows investors to evaluate potential returns and gauge the level of risk associated with specific investments. By calculating 1.20x risk, investors can determine if the potential gain justifies the increased risk and make well-informed investment choices.

2. Business Expansion Strategies

When businesses consider expansion opportunities, they need to assess the risks involved. Calculating 1.20x risk helps business owners evaluate the potential returns and determine whether the benefits outweigh the increased risk. It provides a quantitative measure that can aid in strategic decision-making, assisting businesses in identifying viable growth opportunities.

3. Project Management

Project managers often face the challenge of assessing risks and making decisions based on potential outcomes. By incorporating the concept of 1.20x risk, project managers can identify areas where increased risk may lead to higher rewards. They can allocate resources and plan contingencies accordingly, optimizing project outcomes while mitigating potential pitfalls.

4. Insurance Underwriting

In the insurance industry, underwriters evaluate risk when determining premiums and coverage for policyholders. Understanding 1.20x risk allows underwriters to assess the likelihood of potential losses and price policies accordingly. By factoring in a higher risk threshold, they can provide coverage tailored to individuals or businesses with a greater tolerance for risk.

V. Conclusion

In conclusion, understanding the concept of 1.20x risk in mathematics is essential for making informed decisions and assessing potential outcomes. We have explored the meaning of 1.20x risk and how it can be calculated step-by-step. Additionally, we discussed its interpretation in different contexts, highlighting its connection with probability.

The impact of 1.20x risk on decision-making processes cannot be underestimated. By considering the level of risk involved, individuals and organizations can evaluate potential gains or losses more accurately.

Real-life examples provided further insight into the practical applications of 1.20x risk in various domains such as investments, project management, and insurance.

To summarize, comprehending 1.20x risk empowers individuals to assess risks effectively and make informed decisions based on mathematical calculations.